update on mn unemployment tax refund

Electronically filing your return and choosing direct deposit for your refund is the most secure and convenient way to file your taxes. View step-by-step instructions for accessing your 1099-G by phone.

Minnesota Salt Cap Workaround Salt Deduction Repeal

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release.

. Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. Complete 2020 Schedule M1WFC and include it with 2020 Form M1X.

The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144 billion for tax year 2020. The latter will vary between households depending on overall income your tax bracket and how much of your earnings came from the benefits. Get market news worthy of your time with Axios Markets.

FOX 9 ST. For folks still waiting on the Internal Revenue Service. Update Unemployment Exclusion.

We know these refunds are important to those taxpayers who have. If you qualify for the Working Family Credit after the adjustments for tax law changes you may amend your Minnesota returns to include it. Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes.

We know these refunds are important to. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. Minnesota Unemployment Refund Update.

Minnesota Department of Revenue Mail Station 5510 600 N. The Minnesota State Capitol in Saint Paul Minnesota. The Minnesota Department of Revenue.

According to the latest update on Dec. Subscribe for freeWhats happening. Minnesota Department of Revenue Individual Income Tax.

Refunds for about 550000 filers who paid state taxes on the extra 300 and 600 unemployment payments. September 15 2021 by Sara Beavers. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Paul MN 55145-0020 Mail your tax questions to. Mail your property tax refund return to. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

- The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. Households waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the irs system. In the latest batch of refunds announced in November however the average was 1189.

Federal and MN State unemployment tax refund. Minnesota adjusted my return but the Working Family Credit was not added even though I now qualify for it. In the latest batch of refunds announced in november however the average was 1189.

The Internal Revenue Service has announced that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks. The IRS efforts to correct unemployment compensation overpayments will help most of the affected.

The Internal Revenue Service hasnt said much about. IR-2021-212 November 1 2021. Since you were able to get through to the IRS and they stated that your refund is processing there isnt much more you can do at this point.

Paul MN 55146-5510 Street address for deliveries. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms.

Call the automated phone system. Heres a summary of what those refunds are about. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. Minnesota Department of Revenue Mail Station 0020 600 N.

The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness. Some 2020 unemployment tax refunds delayed until 2022 irs. As of January 27 2022 we have.

Sep 15 2021 0 The Minnesota Department of Revenue has announced that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in. There is no need for taxpayers to file an amended return unless the calculations make.

Staff from the revenue department and Minnesota IT Services have been working to update 2020 tax forms to reflect law changes made in July as well as develop and build a system that is able to.

Ppp Ui Tax Refunds Start In Minnesota

Income Tax Subtraction For Unemployment Benefits New Legislation Would Bring It Back Session Daily Minnesota House Of Representatives

Minnesota Ira Deduction For People 70 1 2

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Wcco Cbs Minnesota

State Of Minnesota Passes 2021 Tax Bill Bgm Cpas

Minnesota Unemployment Relief For Covid 19

Minnesota Mn Unemployment Tax Tpa Instructions

Minnesota Mn Unemployment Tax Tpa Instructions

Mn Sales Taxes If You Re A Business That Sells Taxable Products Or Services In Mn Whether You File Monthly Or Quart Meant To Be Instagram Posts Sales Tax

Minnesota Legislature Passes Federal Conformity Bill

House S Omnibus Tax Bill Proposes 1 6 Billion In Tax Cuts Credits Session Daily Minnesota House Of Representatives

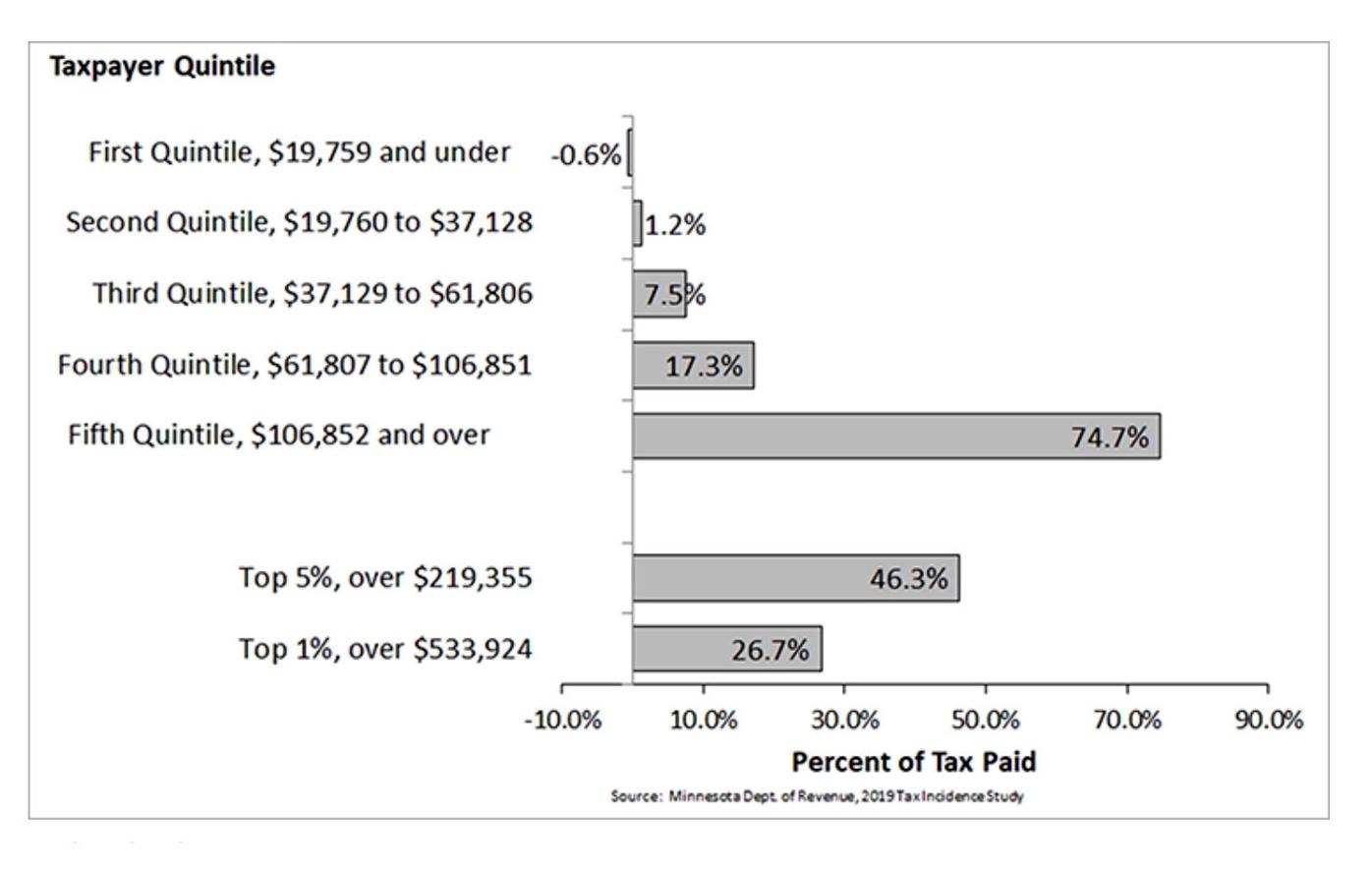

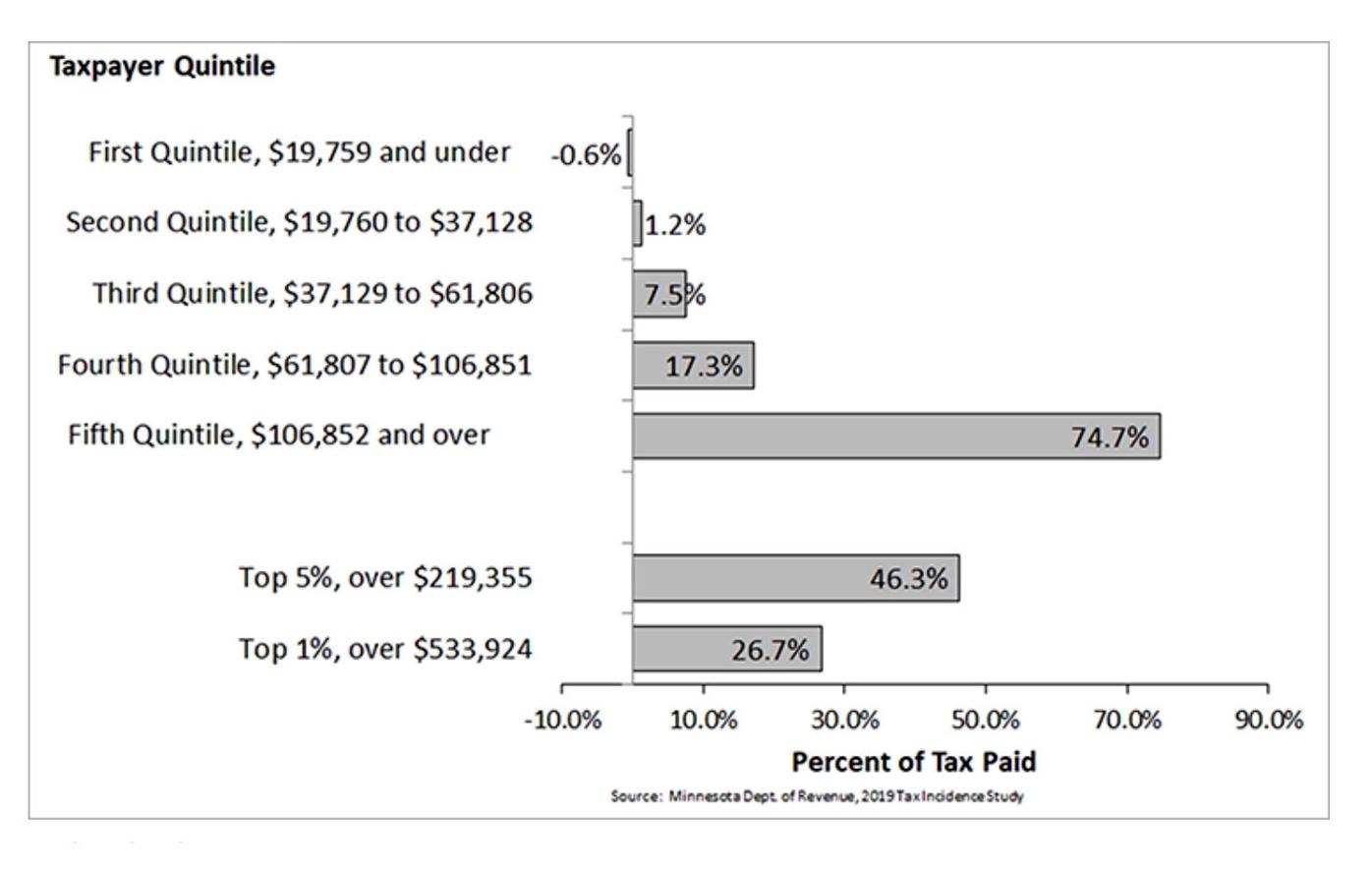

Is Minnesota S Tax System Unfair State Southernminn Com

Minnesota Business Taxes Spike After Legislature Misses Deadline Minneapolis St Paul Business Journal

Where S My Refund Minnesota H R Block

Minnesota Mn Unemployment Tax Tpa Instructions

Minnesota Mn Unemployment Tax Tpa Instructions

Overview Of Minnesota Unemployment Tax Rates For 2022

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions